16/11/2025

Blogs

To locate $three hundred, discover an excellent Flagstar Able Family savings after which care for the typical every day harmony out of $five hundred or maybe more to the basic 90 days. To find that provide, discover an excellent SoFi Checking and you may Bank account and you can discovered being qualified head places totaling no less than $5,100000. Their bonus amount depends upon the complete of your direct dumps you will get https://i24slot.org/en-ca/ regarding the 30-go out analysis window. Pursue Safer Banking will provide you with $100 when you discover a merchant account and you will match the being qualified issues. Those activities should be complete 10 qualifying transactions inside 60 days from registration – those activities is debit cards requests, online statement costs, Pursue QuickDepositSM, Zelle and you will ACH credit. Check out the high Computer game rates offered, which happen to be usually provided by online banking institutions and you may borrowing from the bank unions.

In this case, you’d receive created observe from the Irs demanding one put taxation on the a new faith take into account the brand new U.S. Which publication demonstrates to you your own tax obligations as the an employer, along with agricultural employers and you may businesses whose dominant office is actually inside Western Samoa, Guam, the brand new CNMI, the newest USVI, or Puerto Rico. It shows you the requirements to possess withholding, deposit, reporting, paying, and you will fixing work taxation.

Essentially, you can’t lose insurance fees while the accredited scientific expenses to have Archer MSAs. There will be too much efforts in case your benefits to your Archer MSA to your year is more than the brand new restrictions discussed earlier. An excessive amount of contributions created by your boss are included in the disgusting money. If your excessive share isn’t included in Mode W-2, box step one, you must report the other since the “Almost every other income” on your taxation come back.

If we receive Form 945 pursuing the deadline, we’ll remove Function 945 while the submitted promptly should your package containing Setting 945 are securely addressed, consists of adequate shipping, and that is postmarked because of the U.S. Postal Provider (USPS) to the or before deadline, otherwise delivered by the a keen Irs-appointed personal birth service (PDS) on the or through to the deadline. But not, if you don’t pursue these tips, we are going to think Form 945 recorded in case it is in reality acquired.

Distributions from an enthusiastic Archer MSA that will be used to shell out accredited scientific expenses aren’t taxed. Go into the amount of all the quantity shown within the container 2 away from Function 1042-S which might be repayments away from U.S. source FDAP money (and quantity said below both chapter 3 and you can part 4). The amount on the internet 4 is to equal the entire disgusting quantity from You.S. origin FDAP earnings stated on the web 62c. The brand new quantity claimed on line 63d ought to be the numbers paid off because of the withholding representative from the individual financing instead of as a result of withholding regarding the commission to the recipient. The total amount on the web 63d is to equivalent the sum of the quantity stated inside the box 11 of all the Versions 1042-S taken to readers. Withholding representatives are to have fun with specified part 4 status rules to your Versions 1042-S to possess money produced.

Certainly one of Cash App’s biggest brings is that savers can also be earn up to step three.75% APY, a profit on the par with of the greatest higher-give deals account. To unlock you to high APY, even though, you will need to set up a month-to-month lead deposit from from the minimum $3 hundred. Repayments are increasingly being delivered today and should arrive in “most cases” by late January 2025, depending on the Internal revenue service. Costs was automatically transferred using the banking advice noted on the newest taxpayer’s 2023 tax come back or sent because of the report consider. Qualified taxpayers also needs to found an alternative page notifying him or her from the newest payment.Should make more income outside the afternoon job?

The new now offers that appear on this website come from companies that compensate us. However, that it settlement will not determine all the information i publish, or even the recommendations which you see on this site. We do not range from the world out of enterprises otherwise monetary also offers which are available to choose from. You can or improve your head deposit advice to possess Va impairment compensation, pension advantages, otherwise education pros on the web. Typically, the more you can save for a deposit, the higher – it is possible to owe shorter, rating a lower interest rate, have lesser month-to-month costs and you may a far greater danger of delivering accepted from the lenders.

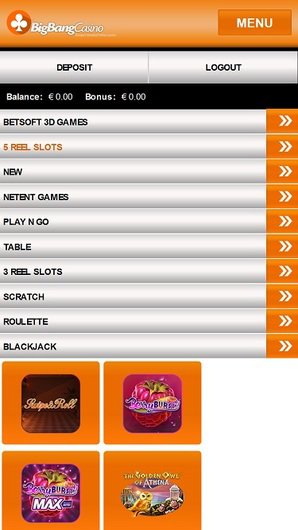

Its “buckets” ability can help you save to own particular purchases otherwise means. 100 percent free revolves are used by the people to try out the newest gambling enterprises without the need to exposure real money, and you may $1 is nearly free. The newest totally free spins can be used for rotating reels on the a particular game, based on the local casino’s campaign. After you’ve burned up each one of totally free revolves, you might withdraw them just after fulfilling the fresh betting criteria. Finder United states try a reports services that enables you to definitely examine various other services organization.

That it area has the legislation one to employers have to follow once they decide to make HSAs available to their staff. You can’t eliminate insurance costs while the accredited medical expenses unless of course the newest premiums is the of one’s following the. Quantity contributed to your 12 months is efforts on your part, your boss, and any other person. They also are any licensed HSA investment shipping built to their HSA.